It might be time to think about shorting the AUDJPY.

It's coming up to a recent high and might not have a lot of legs left.

If we get a decent failure there could be a shorting opportunity for some part of this evening.

See (on the 1 hour)?

Let's keep an eye on this...

... continuing ...

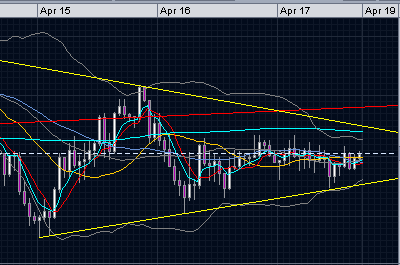

Down on the 1 minute chart we seem to have some resistance to get through before we have the ability to drop:

... continuing ...

Still on the 1 minute:

It's working the support and resistance (for now).

... continuing ...

This might, and I stress might, constitute a break of support in the 1 minute. The reason I'd consider it significant is that the 15 minute and 1 hour have strong stochastic and RSI values which may be ready to reverse soon.

Still watching.

... continuing ...

If I haven't messed up the lines we are definitely drawing outside of them on the 1 minute at this point:

Will it fire? The bollinger collapse is generally indicative that it will decide on a direction before too long. Don't forget, this is the 1 minute, so a move may not be all that huge unless it's the start of a move in a higher time frame.

... continuing ...

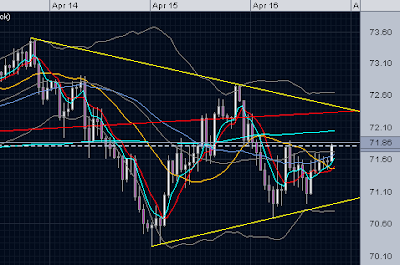

The 15 minute chart doesn't offer much encouragement:

We definitely have to see something conclusive to know what's going to happen. You could always straddle it -- though you'd risk a whipsaw.

... continuing ...

A quick spike, shown on the 15 minute chart, will tempt you to decide:

No failure here yet. Doesn't look promising does it?

I'm not giving up on the potential for this opportunity yet as each of my charts, the 1 minute, the 15 minute and the 1 hour, are all sitting around overbought levels. If the price doesn't get above it's recent high we could see a pullback.

And, yes, of course it could decide to blow right through resistance and throw the short idea to the scrap heap.

... continuing ...

Only 15 minutes left before the hourly chart moves to a new candlestick. This would be a good time for the market to decide what to do. If we hold at this price, but don't go much higher, then the stochastic and RSI would be in a real good position to roll over.

Still watching.

... continuing ...

Gah, no movement at all makes me paranoid! Here's the look of the 1 hour chart at the moment:

We have a touch... similar to an earlier touch that lead to a decline. This touch happens to be lower. We could get some movement. No promises, but we could.

... continuing ...

I'm not the only person thinking this. Here, on the 1 minute, you can see the downward drift as we near the turn of the hour:

Still no promises... maybe it's a feint.

... continuing ...

This, on the 1 hour chart, looks bearish to me. If it is, it could still take a hours to be clear:

Maybe I'll develop more patience through trading?

Perhaps the real move is based on a possible upside down head and shoulders pattern?

Nobody can really say.

Why am I following this idea? Well, if it's right, and it works out as good as might possibly be expected, it could end up being worth about 100 pips. That's worth a little bit of work. If I'm wrong, well, I lose a few pips if I'm tricked into thinking I'm right.

... continuing ...

It's looking a bit robust on the 1 hour:

Did I mention I love my new screen clipping tool?

... continuing ...

You know, if we continue to sit around and do nothing, except maybe fall just a little, we could end up with a tweezer top on the 1 hour:

Now, that I'd find bearish!

... continuing ...

The latest 1 hour looks a bit more promising -- not sure how long it will stay that way of course:

I'm going to buy myself a beer if I end up having read the short on failure action correctly.

... continuing ...

Well, shoot, a shiny new tweezer top type setup and no reaction. The tails must not be long enough. Stupid market, trix are for kids!

.. continuing ...

Just to finish off this post -- I have finally seen movement:

The lack of immediate gratification, and the lack of robust response, has taken some of the joy out of being somewhat correct.